Blueprint: The MicroStrategy Precedent

MicroStrategy is the first and largest Bitcoin Treasury Company. Michael Saylor famously pivoted MicroStrategy's corporate treasury strategy toward Bitcoin – setting a bold example for digital asset enthusiasts. The story behind this move provides a conceptual framework for understanding how MegaStrategy harnesses volatility.

A Brief History

Michael Saylor & MicroStrategy

Michael Saylor is the Founder and Chairman of MicroStrategy. While MicroStrategy had been in operation for decades as a business intelligence company, its corporate profile changed in 2020 when it began allocating a substantial portion of its treasury (nearly all of it) into Bitcoin.

The Initial Move into Bitcoin

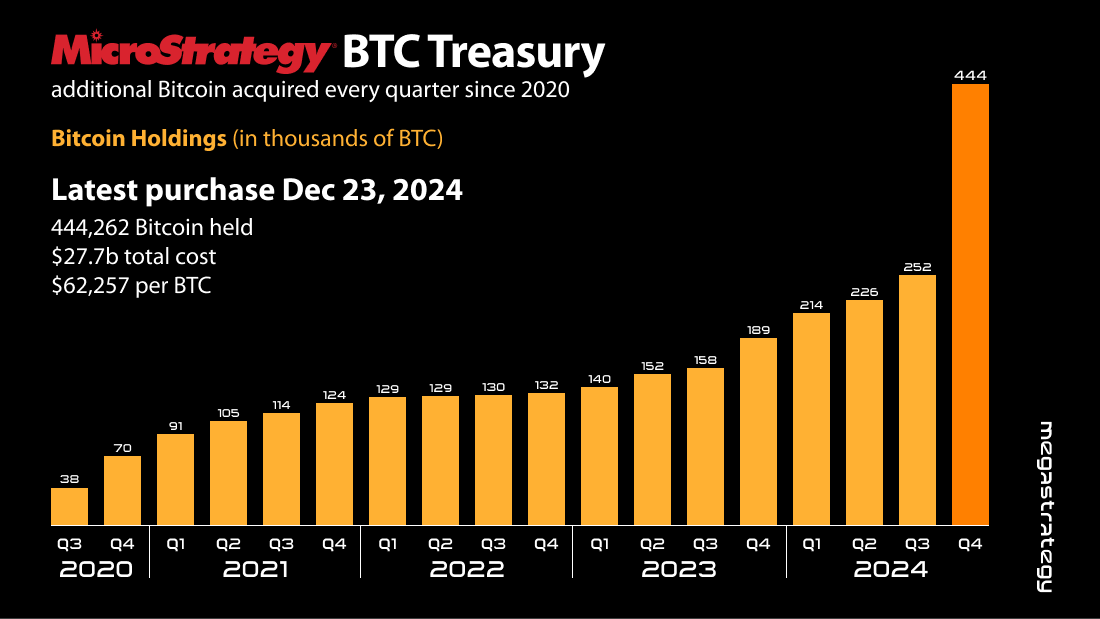

In August 2020, MicroStrategy announced that it had purchased $250 million worth of Bitcoin as a treasury reserve asset. Saylor cited concerns over fiat currency devaluation and the potential long-term upside of digital assets. This was just the beginning – a series of larger purchases would follow:

For a more in-depth review of their Bitcoin purchases, see the MicroStrategy Portfolio Tracker

For a more in-depth review of their Bitcoin purchases, see the MicroStrategy Portfolio Tracker

Enter Convertibles

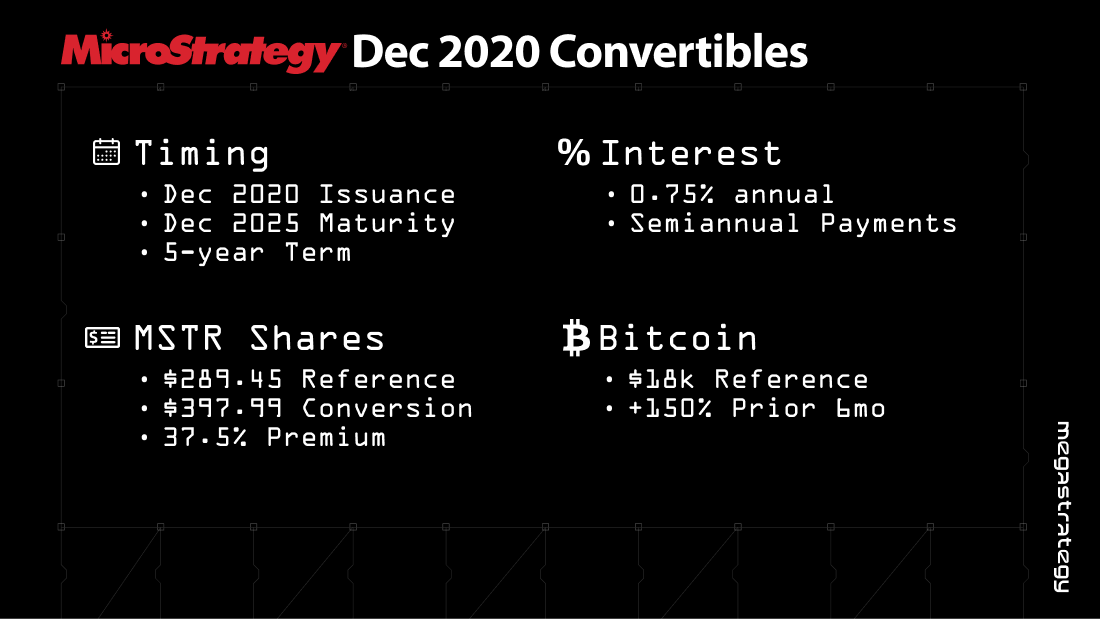

Central to MicroStrategy's... strategy (for lack of a better term) is the use of "intelligent leverage" – rather than simply allocating surplus cash into Bitcoin, the company raised debt through convertible notes to purchase even more BTC. Here's a simplified breakdown of the process:

1. Debt Issuance

- MicroStrategy sold convertibles – financial instruments that can be converted into MSTR shares

- Conversion rights help secure lower interest rates on the debt compared to traditional bonds

2. Deployment of Proceeds

- Funds raised from these notes were used to purchase additional Bitcoin

- As the price of Bitcoin appreciated, the overall treasury value increased dramatically

3. Ongoing Strategy

- MicroStrategy repeated this process several times, incrementally raising billions of dollars

- Each new capital infusion was immediately used to acquire Bitcoin at varying price poins

Why This Matters

Exposure to Volatility

MicroStrategy’s approach harnesses Bitcoin’s volatility. While many corporations seek to minimize risk by diversifying treasury assets, Saylor effectively embraced Bitcoin’s price fluctuations. If BTC’s price increases, the leveraged position magnifies gains. Conversely, it also exposes the company to amplified downside risk.

Financial Engineering

Saylor’s use of convertible notes to fund the Bitcoin position introduced a novel financial engineering dimension. MicroStrategy wasn’t just investing – it was creating a perpetual debt-financed position. The company’s confidence in Bitcoin’s long-term price trajectory underpinned this approach.

Market Implications

MicroStrategy’s public stance and recurrent BTC acquisitions bolstered market sentiment, demonstrating that even large corporations could take on significant Bitcoin exposure. It also sparked ongoing debates around corporate risk, governance, and Bitcoin as a treasury reserve asset.

Key Takeaway

By studying how MicroStrategy structured debt, navigated risk, and broadcast its vision for a digital future, we gain insight into how a similar approach can be implemented onchain using decentralized infrastructure. These lessons guide MegaStrategy’s mission to scale, adapt, and thrive in Ethereum’s rapidly evolving financial landscape.